In the wake of the global financial crisis, the importance of regulation in managing systemic risk has been underscored. Systemic risk refers to the potential for a disruption or failure in the financial system that can have far-reaching consequences on the economy. In this article, we will delve into the crucial role that regulation plays in addressing systemic risk and ensuring financial stability.

Understanding Systemic Risk:

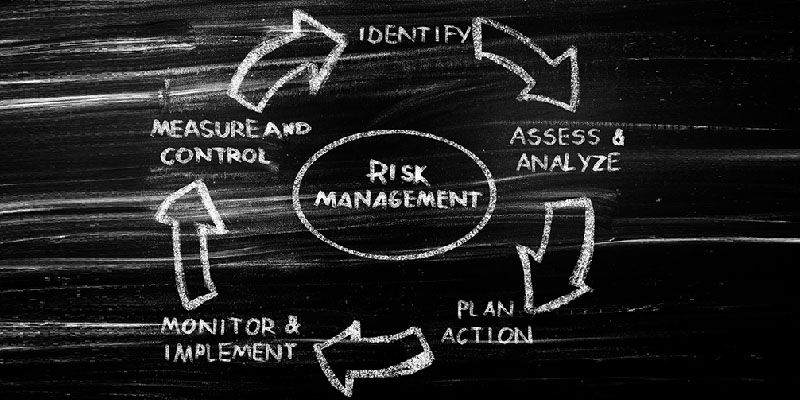

Systemic risk emerges when the failure of a single institution or the interconnectedness of multiple institutions poses a significant threat to the stability of the financial system. Factors such as excessive leverage, inadequate risk management practices, interconnectedness, and asset price bubbles can contribute to systemic risk. Recognizing the severe implications of systemic risk, regulatory frameworks aim to identify, monitor, and mitigate potential risks to protect the overall economy.

Enhancing Capital and Liquidity Requirements:

Regulators enforce capital and liquidity requirements on financial institutions to ensure they maintain sufficient buffers to withstand adverse shocks. Heightened capital and liquidity ratios bolster the resilience of institutions, reducing the likelihood of financial distress. Stricter capital adequacy standards enhance the stability and solvency of the financial system, thereby mitigating systemic risk.

Implementing Prudential Regulation:

Prudential regulation focuses on the soundness and stability of individual financial institutions. It involves establishing guidelines and standards for risk management, corporate governance, internal controls, and transparency. By enforcing compliance with these standards, regulators aim to prevent excessive risk-taking and foster responsible behavior within the industry. Prudential regulation identifies and addresses potential weaknesses that could amplify systemic risk.

Promoting Market Transparency:

Regulators play a pivotal role in promoting market transparency by requiring financial institutions to disclose relevant information to the public. Increased transparency enhances market efficiency, facilitates informed decision-making by investors, and aids in identifying potential risks. By mandating accurate and timely reporting, regulators aim to prevent market distortions and improve the overall functioning of financial markets.

Conducting Macroprudential Oversight:

Macroprudential oversight entails monitoring and addressing risks that arise from the collective behavior of financial institutions and interactions between different sectors of the economy. Regulators employ tools such as stress testing, scenario analysis, and surveillance of key indicators to assess systemic risks at the macro level. By identifying vulnerabilities and implementing targeted measures, regulators mitigate the build-up of systemic risk and foster financial stability.

Fostering International Cooperation:

Systemic risks transcend national borders, necessitating effective international cooperation. Regulators collaborate with counterparts in other jurisdictions to harmonize regulatory frameworks, share information, and coordinate efforts to address cross-border systemic risks. International cooperation enhances the effectiveness of regulation and helps mitigate the spillover effects of systemic risks across countries.

In conclusion, the role of regulation in mitigating systemic risk cannot be overstated. It serves as a crucial pillar in ensuring the stability and resilience of the financial system, protecting the economy from widespread disruptions. Through a comprehensive regulatory framework, regulators address various aspects of systemic risk, including capital and liquidity requirements, prudential regulation, market transparency, macroprudential oversight, and international cooperation.

By enforcing capital and liquidity requirements, regulators enhance the financial strength and resilience of institutions, reducing the probability of failure during economic downturns. Prudential regulation promotes responsible behavior and risk management within individual institutions, mitigating the potential for excessive risk-taking. The promotion of market transparency ensures that accurate and timely information is available to investors, improving market efficiency and facilitating informed decision-making.

The implementation of macroprudential oversight enables regulators to monitor systemic risks at a broader level, identifying vulnerabilities and implementing targeted measures to prevent the build-up of risks. International cooperation is crucial in today's interconnected global financial system, allowing regulators to address cross-border risks and coordinate efforts to maintain stability.

While regulation is essential for managing systemic risk, it is important to strike a balance between effective regulation and fostering innovation and growth. Excessive or overly restrictive regulation may hinder economic development, stifling innovation and impeding the efficient functioning of financial markets. Thus, regulators need to ensure that regulations are well-designed, adaptive, and supportive of sustainable economic growth.

Overall, the influence of regulation in mitigating systemic risk is crucial for safeguarding financial stability. By implementing comprehensive and robust regulatory frameworks, authorities can proactively address potential risks, protect the interests of consumers, and maintain confidence in the financial system. Effective regulation contributes to a resilient and sustainable financial system, fostering economic growth and prosperity.